Mango Finance

May 19, 2025

all plans

Mango is now offering an exclusive payment plan option for your clients via Mango Finance.

With this option, your firm can offer fully-funded, monthly pay-over-time plans that give your clients a flexible way to pay their invoice. You get paid the full amount financed upfront, leading to a reduction in aging Accounts Receivable.

It is simple to set up and there is no cost to you. Your clients pay their amount due over time with a low, flat-rate interest charge.

For more information on setting up Mango Finance monthly payment plans for your clients, contact care@mangopractice.com.

Benefits of Mango Finance

Mango Finance provides your clients with the flexibility to pay over 3-12 months, while we fund your firm upfront and in full, at no cost to your firm.

Firm Benefits

- Get paid upfront every time

- Get paid faster by clients

- Reduce aging A/R

- Sell more of your services to clients

- Offer a better client experience with more options for payments

Client Benefits

- Flexibility to pay over 3-12 months

- Makes services more affordable

- Improved cash flow management

- Great client experience – Having more choices for invoice payment

Firm Cost

It costs nothing for a firm to offer Mango Finance. In fact, your firm gets paid the full amount financed by the client upfront!

Client Cost

Our interest rates are industry standard and based on national averages. You can work directly with your Mango Finance Customer Success Representative to help provide quotes to your clients.

Using Mango Finance

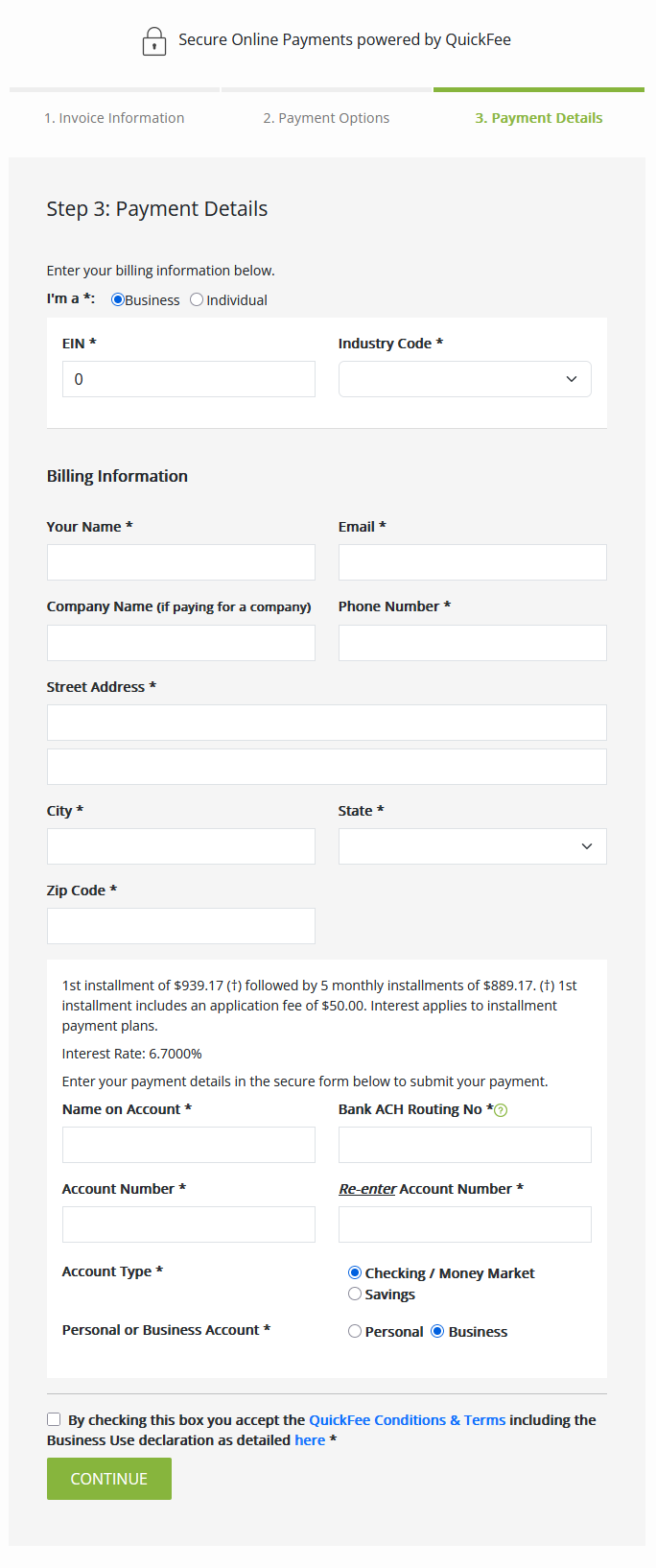

Once the client receives the quote, they must select the desired term (3, 6, 9, or 12 months, depending on what options your firm allows). Clicking in the space above the term will open the Payment Details online form.

Once the client fills out the form and clicks Continue, the following will occur:

- A receipt will be displayed to the client.

- An email will be sent to the client and the firm.

- Mango Finance underwriting will approve the application in 24 hours or less.

- In three business days, the firm will be paid in full and the client’s first payment will be withdrawn.

FAQs

- How does Mango provide financing?

- Mango has partnered with QuickFee Finance to offer our accounting firm customers these exclusive client financing options. QuickFee has originated over $600 million in monthly payment plans for top accounting and law firms, helping them get paid faster for their hard work. When clients have the option to pay over time, your firm will quickly start to see reduced Accounts Receivable, improved cash flow, and stronger client relationships.

You can learn more about QuickFee by visiting their website at lp.quickfee.com/mango-partnership.

- Why do I need to disclose our P&L balance (financials for 2 years)?

- Mango Finance has limited recourse, so we need to know that firms are in good financial standing if a client’s financing plan defaults. In the rare instance that a loan defaults, the remaining principal amount will need to be collected directly from the firm. This happens less than 1% of the time.

- Is Mango Finance the same as debt factoring or fee factoring?

- Debt factoring is when a company buys an outstanding invoice from a firm and then collects directly from their client. Mango Finance does not provide debt factoring and Mango Finance provides many benefits over factoring.

Top benefits of using Mango Finance over factoring:

- The firm always owns and maintains the relationship with the client. We will only engage with your client with the firm’s express permission.

- The firm is always funded in full. We do not buy the debt and the firm receives 100% of the invoice value.

- Debt factoring or collections can affect the firm’s public liability insurance, whereas Mango Finance does not.

- What do my clients need to do to get approved for financing? Are there any credit or background checks?

- This is what makes the Mango Finance option unique. Mango Finance does not need any credit or background checks, which means it does not affect your client’s credit score. Clients are automatically approved for their loan based on their relationship with you. This allows the firm to deliver an easy and convenient client experience.

The firm does retain the right to decline Mango Finance to clients based on their payment history, or for any other reason.

- Can Mango Finance deny my client from getting a payment plan?

- The firm always retains ownership and control of the client experience, and the firm is the only one who can deny a payment plan. Mango Finance does not deny any of your clients who apply for a payment plan. We will automatically approve any plan under $25k, and use a soft-pull credit check over $25k to ensure their identity and make sure they are not bankrupt.

- What control does the firm have over their Mango Finance option?

- Firms always have the choice to approve or deny specific clients.

- Can all my clients use Mango Finance?

- This option is intended for your business-to-business (B2B) clients only, not business-to-consumer (B2C). However, we have seen some instances where a B2B client might do business with the firm from a personal standpoint. In this case, the client is able to combine both payments into the Mango Finance plan. Mango Finance will still consider this a B2B invoice, and the client will need to enter their EIN number and other information to get approved for a Mango Finance plan. The firm always reserves the right to offer this service to select clients.

There is a minimum invoice amount (generally between $2,000 and $5,000, with some outliers), depending on state regulations. Additionally, Mango Finance is unable to offer Mango Finance to clients in Nevada, North Dakota, South Dakota, or Vermont due to regulatory restrictions. Please work directly with your Mango Finance Customer Success Representative to confirm the requirements that apply for your business.

- What are the rates for your 3, 6, 9, or 12-month financing options?

- Clients pay a low, flat-interest rate on their payment plan depending on the terms. Our interest rates are industry standard and based on national averages. Note that there is no prepayment penalty, which your clients can appreciate. You can work directly with your Mango Finance Customer Success Representative to help firms provide quotes to your clients.

- Is there a minimum loan?

- The minimum varies state by state, generally ranging between $2,000 and $5,000 (with a few outliers that cap out at $15,000 and $25,000) depending on where the firm is located. We are unable to offer Mango Finance to clients in Nevada, North Dakota, South Dakota, or Vermont due to regulatory restrictions.

- Is there a maximum loan?

- There is not a maximum loan amount per se, but there is a lending limit for your firm based on your revenue, financials, and the overall health of the firm (normally 10% of annual revenue.)

- Is there an additional cost associated with using Mango Finance?

- No, there is no additional cost to offer Mango Finance to your clients.

- What are your financing default rates?

- We have seen very few instances in all the firms we serve where the client is unable to pay off their debt. The default rates are less than 1%.

- When is recourse initiated?

- If Mango Finance is unable to debit a client’s account for an installment, our team will attempt another automatic debit in 2 business days. If the debit fails again, we will reach out to the firm to coordinate a final attempt to collect funds for the installment. Then, if we are still unsuccessful on the third attempt, recourse will be initiated. Note that this is very uncommon and applies to less than 1% of all Mango Finance payment plans.

We also offer an option for clients near default to defer their fees for up to a month. There is a $50 charge for that service.

- What happens when the client defaults on their Mango Finance plan?

- If a client defaults on their Finance plan, the firm pays off ONLY the remaining principal. There are no fees or charges added to this balance and no interest charged to the firm.

The firm can also take over the repayments (if they choose) noting that the firm would bear the interest charges in that instance.