Import Tax

September 3, 2024

all plans

Mango allows you to easily import clients and invoices that you have prepared tax returns for in ProSeries, Lacerte, Drake, UltraTax, or ATX. Depending on the tax vendor, this includes returns using Form 1040, 1120, 1120S, 1065, and 1041.

It is important to note that if customer names are not identical between Mango and the tax software, duplicate clients may be created which will require you to manually clean up the records. Please contact Mango Support if you have questions before using this utility.

Accessing Tax Imports

You can access the Import Tax window from the main toolbar.

- Click

(Settings).

(Settings). - Click

Import Tax.

Import Tax.

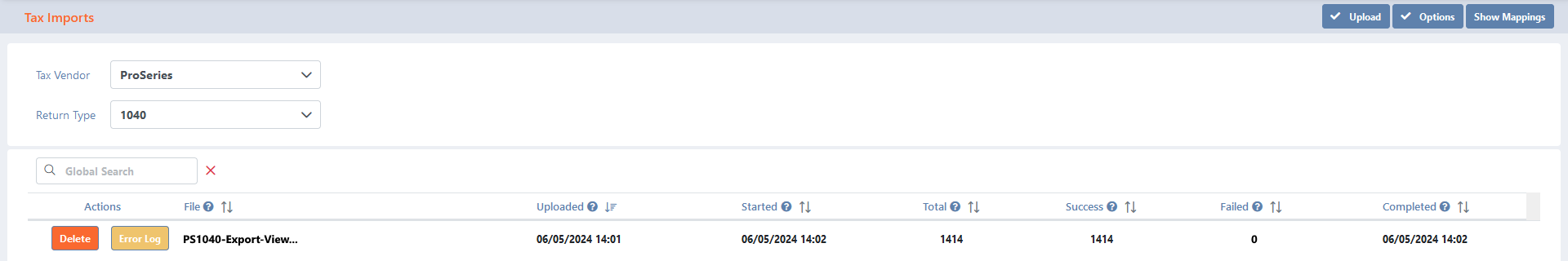

Using Tax Imports

While viewing the Tax Imports window, the following options are available.

At the top of the list is a button to ✓ Upload tax data, configure ✓ Options for the selected return type, and Show Mappings to see required fields.

Configuring Import Options

You can configure settings for importing taxes from the Tax Imports window.

- Select the Tax Vendor (ProSeries, Lacerte, Drake, UltraTax, or ATX).

- If applicable, select the Return Type (1040, 1120, 1120S, 1065, or 1041).

- Click the ✓ Options button to open the Tax Import Options window.

The following settings are available.

Client Settings

- Select Add New Clients Only to import new clients but not update any existing clients; or, select Add / Update Clients to allow changes to existing clients.

- Select Search by Client Name to use the name of the client to determine if they already exist in Mango; or, select Search by Client Number to use the number assigned to the client. Note that client numbers are optional.

- Specify the Assign Engagement that will be used for new clients.

- Specify the Assign Billing Partner that will be used for new clients.

- Specify the Assign Originating Partner that will be used for new clients.

- Specify the Assign Staff that will be used for new clients.

- Specify the Assign Client Type that will be used for new clients.

Invoice Settings

- Select Don’t add Invoices to not add an invoice for the imported taxes; select Add Invoices w/ Payment to add an invoice for the import taxes as well as a payment for that invoice; or, select Add Invoices w/ no Payment to add an invoice for the imported taxes without a payment.

When you are done configuring the import settings, click ✓ OK.

Uploading Tax Imports

You can upload new tax records from the Tax Imports window.

- Select the Tax Vendor (ProSeries, Lacerte, Drake, UltraTax, or ATX).

- If applicable, select the Return Type (1040, 1120, 1120S, 1065, or 1041).

- Click the ✓ Upload

- Drag the tax record file to the Upload File pane, or Click to Browse and select the tax record file. (Note: The import file must be saved in a comma-separated value, or CSV, format.)

- Adjust the Tax Import Options as necessary.

- Click ✓ OK.

- Click the Start button to begin the import process.

Reviewing Imported Taxes

Select the Tax Vendor (ProSeries, Lacerte, Drake, UltraTax, or ATX) and, if applicable, the Return Type (1040, 1120, 1120S, 1065, or 1041) to see a list of imported tax records.

The Global Search field can be used to locate records containing specific text. Once specified, an indicator will be displayed showing how many records contain that text. To clear the search, click the red X icon to the right of the field.

You can click on the header of many columns to sort the records shown by the values in that column. Click the header again to reverse the sort.

The Actions column provides options to perform an action on a specific entry.

- Click Start to begin the import process for an uploaded tax import file. Once the import is started, this button is hidden and unavailable.

- Click Delete to delete the import record. This only deletes the history of the import, not any records created.

Common Questions About Tax Imports

- Will importing taxes also create invoices?

- For all software applications except Drake, importing tax will also import invoices for those services.

- Why can’t I select the type of tax services I’m importing?

- For ATX and UltraTax, the service type is included in the import so you do not need to select it during the import process.

- How do I import tax services from ProSeries?

- Use the following steps to create a report in ProSeries which can be imported to Mango.

- In ProSeries, select the HomeBase view for the service type (e.g., “1040”).

- On the menu bar, select HomeBase.

- Select Column Headings.

- Select the following fields:

- Company Name

- City

- State

- Zip Code

- Client Street and Apt Address

- Optionally select any of the following fields:

- Client Number

- Home Telephone

- Taxpayer E-mail Address

- Client Fax Number

- Total Fees

- Date Billed

- Date Paid

- Spouse Birthdate

- Spouse First Name

- Spouse Last Name

Note: You can access this list of fields by clicking Show Mappings in the Tax Imports window.

- Click OK.

- Save the HomeBase view and name.

- On the menu bar, select Export View. This file can be imported to Mango.

- How do I import tax services from Lacerte?

- Use the following steps to create a report in Lacerte which can be imported to Mango.

- On the menu bar in Lacerte select Client.

- In the Tax Type section, select 1040, 1065, 1120, or 1120s.

- Select Client and then choose Group Select.

- Select the fields to export, depending on whether the clients are individual or business.

- For individual clients, select the following fields:

- Client Full Name

- City

- State

- Zip Code

- Street Address

- For individual clients, optionally select any of the following fields:

- Client Number

- Taxpayer Home Telephone Number

- Taxpayer Work Telephone Number

- Taxpayer Mobile Number

- Taxpayer Fax Number

- Taxpayer E-mail Address

- Country

- Apartment Number

- Total Fee – Invoice

- Amount Due – Invoice

- Processing Date

- Invoice Number

- Spouse Date of Birth

…or…

- For business clients, select the following fields:

- S-Corporate Name

- City

- State

- Zip Code

- Street Address

- For business clients, optionally select any of the following fields:

- Client Number

- Phone Number

- Fax Number

- Email Address

- Total Fee – Invoice

- Amount Due – Invoice

- Processing Date

- Invoice Number

Note: You can access this list of fields by clicking Show Mappings in the Tax Imports window.

- For individual clients, select the following fields:

- Optionally verify where the data will be saved and the file name.

- Click Export. This file can be imported to Mango.

- How do I import tax services from Drake?

- Use the following steps to create a report in Drake which can be imported to Mango.

- On the menu bar in Drake select Reports/Report Manager.

- Select My Reports.

- Click New Report.

- Select Tax Return Data.

- Create one export report for 1040s, and another for All Clients.

- In the Tax Type section, choose 1040, 1065, 1120, or 1120S.

- Select clients to export. (Tip: Press F3 to use the “group select” feature, or hold the Ctrl key and left click to select multiple non-consecutive clients.)

- On the menu bar, select Client.

- Select Export>Export to file.

- Expand the Client Information, Client Status, and Client Invoice groups.

- Select the following fields and click the > button to copy it to the Display section.

- Taxpayer Name

- City

- State

- Street Address

- Optionally select any of the following fields and click the > button to copy it to the Display section.

- Client Number

- Taxpayer Daytime Phone

- Taxpayer Cell Phone

- Taxpayer Email Address

- Zip Code

- Apartment

Note: You can access this list of fields by clicking Show Mappings in the Tax Imports window.

- Click OK to create the export. This file can be imported to Mango.

- How do I import tax services from UltraTax?

- Use the following steps to create a report in UltraTax which can be imported to Mango.

- On the Utilities menu in UltraTax, select Data Mining.

- In Step 1:

- In the Client database field, select the tax type to export (e.g., “1040 Individual”).

- Click Continue (Step 2)….

- In Step 2:

- In the Print selection group, select Export report.

- Click Design Custom Reports.

- Click Add.

- In the Description field, enter a name (e.g., “Mango1040”).

- Leave the Template field blank.

- Click Continue.

- Select the following fields:

- Client name

- Contact city

- Contact state

- Contact zip code

- Contact address 1

- Optionally select any of the following fields:

- Contact home phone

- Contact work phone

- Contact cellular

- Contact fax

- Contact email address

- Contact address 2

- Contact name

- Net invoice amount

- Invoice payments

- Invoice number

- Click Continue.

- In the Product field, select “Federal.”

- In the Search name field, select “All clients.”

- Click Continue (Step 3)….

- In Step 3:

- In the Format section, select Excel.

- Set the Include column headings check box.

- Optionally click Change Location to select where the file will be saved.

- Click Export. This file can be imported to Mango.

- How do I import tax services from ATX?

- Use the following steps to create a report in ATX which can be imported to Mango.

- On the Option menu in ATX, select Customize Fields. (Note: You may want to note your current options, so you can restore these settings after creating the export file.)

- Select the following fields:

- Company Name

- City

- State

- Zip

- Address

- First Name

- Last Name

- Optionally select any of the following fields:

- Client Number

- Telephone

- Amount Billed

- Amount Paid

- Date Billed

- Filer DOB

- Spouse First Name

- Spouse Last Name

- Spouse DOB

Note: You can access this list of fields by clicking Show Mappings in the Tax Imports window.

- Clear all other fields.

- Clear any returns you do not want to import, such as duplicates of transactions in Mango.

- Verify that no Social Security or ID numbers are duplicated or missing.

- On the Reports menu, select Export Marked Client List. This file can be imported to Mango.

After creating the export file, you can select Options | Customize to restore your previous settings.

See It in Action

Learn More

The following knowledge base articles contain additional information relating to Tax Imports: